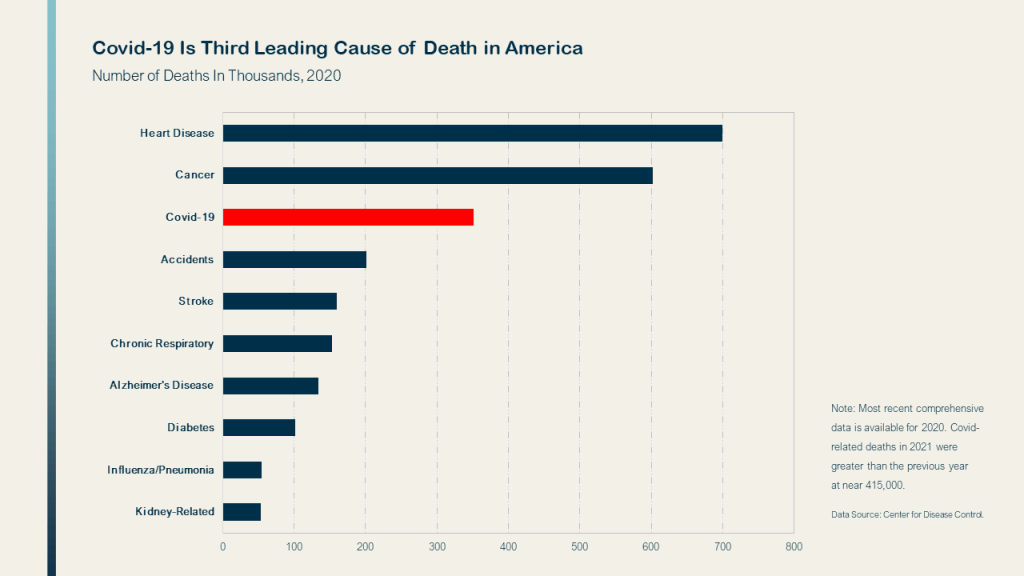

We are responsive to the view that a pandemic ends when people say that it ends. Despite the more casual attitude toward Covid-19 in diverse geographies, statistics remain sobering, at least here in the United States. According to the Center for Disease Control, some 120,000 people died directly from Covid-19 in the first three months of 2022. Used hastily, the figure implies that we could see a mortality number near 480,000 for the year. Even if we are criticized for such enthusiasm, a more moderate tally is still too high, in our view, when compared with other causes of death in America.

Click on image to enlarge.

Intuitively, the number of deaths related to Covid-19 should be closer to the number for influenza and pneumonia, than the one for cancer. We are far from that mark. What will it take to bring down this total? The brass-tacks answer is billions of dollars in capital mobilization for scientific research, both in the private and public sectors.

If the pandemic is ending—a point of obvious controversy—then why invest even more money? There is merit to this argument. The Spanish flu pandemic of 1918 was relegated to history in a manner of a few years. By 1921, Americans were more in interested in discussing Babe Ruth’s home run record or getting samples of the new Chanel No. 5 perfume from Paris, than analyzing public-health data. But there is no natural law that says that pandemics fizzle out because of herd immunity. The risk is that the opposite could happen.

Fueling the research engine that will conquer the many variants of Covid-19 is likely to take a decade, if not longer, depending how aggressively the virus mutates. Today there may be at least six variants of interest, including Omicron and BA.2, Delta, Delta AY.4.2, Beta, and Alpha. Further changes in the coronavirus structure are likely. Exponential growth in this number is possible. We note that Omicron was first detected in South Africa at the end of November 2021 and spread to become the dominant strain worldwide in a matter of a few months; it has wreaked havoc in Hong Kong.

In the United States, one reason that time is working against scientists is the breadth of competing interests for government funding. The National Institutes of Health has 299 categories for budgeting research projects. Some of these buckets overlap in the case of Covid-19 funding. Still, we will let medical ethicists decide whether Alzheimer’s Disease, to cite one example, is more or less deserving of government monies than coronavirus-related research.

Investors may want to think about a decade-long horizon when evaluating relevant healthcare and medical-technology opportunities. It may be pleasant fiction to conclude that Covid-19 is fast dissipating. Certainly, progress on an absolute basis is convincing. Advances on a relative basis are less conclusive. ■

Our Vantage Point: We are learning how to live with Covid-19 as a near-permanent part of lifestyle choices. In this setting, zero-Covid is unrealistic, but bringing down mortality rates to align with other common causes of death is achievable over time.

Learn more at Scientific American

© 2022 Cranganore Inc. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image Credit: Eric1513 at Can Stock Photo.