Our work is research-based, reflecting our heritage in the investment-banking industry. We benefit from the wisdom of others and their disparate voices. Check back regularly for fresh suggestions.

Required Notification: The website sponsor is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com.

► Among Bestsellers

amazon.com affiliate link

The Sassoons

The Great Global Merchants and the Making of an Empire

Joseph Sassoon

The Sassoons were to global trade what the Rothschilds were to global finance. They were also a lot more interesting. This marvelous narrative sprouts from previously untapped family archives. In the 19th century, David Sassoon, the founder of the dynasty, and his brood managed to connect London and Bombay, Calcutta and Shanghai in improbable ways. They made a fortune in the cotton and opium trades, among other ventures. The rags-to-riches component of this story is less gripping, though, than the stories behind the unraveling of the family empire. We have a ringside seat here to the implosion of unrivaled wealth, provoked by back luck and poor decisions. One trip switch—among many—was the Sassoon’s alignment in China with the anticommunist Kuomintang. Their assets were nationalized after the communist takeover in 1949. The author, Joseph Sassoon, is indeed a family descendant. Those who fear the book may be ancestral revisionism to re-calibrate the clan’s legacy can relax. This portal on world economic history is as lively, as it is critical.

Use an [ affiliate link ] to purchase this book. Help keep our content free for all.

► Company Valuation

amazon.com affiliate link

The Dark Side of Valuation

Valuing Young, Distressed, and Complex Businesses

Aswath Damodaran

This MBA-level textbook, now in its third edition, was published in 2018, well before Covid-19 existed. Yet, the material is essential today, as buyers and sellers of companies wrestle with valuation as the fundamental issue of a transaction. How do set the price for a company when its intrinsic value (cash-flow potential and its risk) is indeterminate? “A common response is to bend the rules of valuation and use shortcuts to justify whatever price they are predisposed to pay for the company.” Aswath Damodaran refers to this approach as the “dark side of valuation.” The stance is pervasive in the coronavirus era, suggesting that now is the time to double-down on basic techniques and core principles. In this academic work, the material on declining companies, sadly, is particularly relevant, given new-found distortions in the global economy. The final chapter, The Jedi Way: Vanquishing the Dark Side, is a must-read essay on making better judgements and estimates.

Use an [ affiliate link ] to purchase this book. Help keep our content free for all.

► Due Diligence

amazon.com affiliate link

Bad Blood

Secrets and Lies in a Silicon Valley Startup

John Carreyrou

Bad Blood is a visceral read for venture-capital insiders. The archetypes who bring the story to life are well-known in business circles. There is the founder who wants to change the world; investors who have more money than they know what to do with; and lawyers who veer off-course in pursuit of their version of justice. Because this narrative relates to health care, you find regulators who are too underfunded to do their work correctly and in-house lab technicians who are undercut by startup management. In one of the book’s most poignant accounts, we learn that a chief scientist was driven to suicide. Those real-life characters are why this book is a must-read. Most professionals will know a handful of them. Meanwhile, the background on Elizabeth Holmes reduces her to a commercial curiosity, rather than an industry icon. Given the pain she inflicted on many in the pursuit of her gains, she deserves the harsh moniker, at minimum. The author argues that Holmes knew exactly what she was doing, rather than subject the reader to the indefensible notion that she was somehow victimized by circumstances.

Use an [ affiliate link ] to purchase this book. Help keep our content free for all.

► Economic Diplomacy

amazon.com affiliate link

China and Japan

Facing History

Ezra F. Vogel

The fact that China and Japan: Facing History is authored by Ezra Vogel should be enough of a reason to read this book. The Harvard professor is among the few recognized for his cutting-edge analysis on both nations. With this material, Vogel fills an important void in Asian studies by coalescing Japanese and Chinese narratives; all too often they are treated separately. That silo approach in part is rooted in the complex ties, both current and historical, between the two nations. Vogel, as a third party, does an exceptional job at resolving the two perspectives in ways that a Chinese scholar or Japanese scholar would have less authority. While he points out that the historical record—the public face of which has been largely scrubbed—validates ongoing tensions, he charts a course for the two nations to reconcile their often-strained relationship. Readers will appreciate the candor with which Vogel tackles his assignment, relying on lifetime of on-the-ground work to reinforce and validate his crisp geopolitical views.

Use an [ affiliate link ] to purchase this book. Help keep our content free for all.

► Emerging Markets

amazon.com affiliate link

The New Map

Energy, Climate, and the Clash of Nations

Daniel Yergin

The New Map would seem to be more about fossils fuels than emerging markets. Think again. The pursuit of oil wealth or the cost of energy resources are common threads across the developing world. Following in the wake of The Quest and the Pulitzer-winning The Prize, Yergin has assembled voluminous analysis in this book that clarifies the priorities of energy-hungry China and the future of oil-dominated Russia, juxtaposed against the shale revolution in the United States. Caught in the middle of those shifting geopolitics are the Gulf states and Iran, all of which are keenly aware of the dour outlook for their commodity-as-ATM economies. The key question for emerging markets everywhere is how they will respond to the knock-on effects of the diminishing oil economy? How will they embrace the ascent of electric vehicles and the impact of environmental priorities? At one time, the best starting point for emerging-markets studies was the Cold War. The new starting point may be fossil fuels.

Use an [ affiliate link ] to purchase this book. Help keep our content free for all.

► Florida Commerce

amazon.com affiliate link

Buying Disney’s World

The Story of How Florida Swampland Became Walt Disney World

Aaron H. Goldberg

This book is far more than a historical treatise on Disney World. It is also a snapshot of the Central Florida economy in the 1960s. Visiting Orlando today, tourists may find it incomprehensible that the region was once better known for its orange groves and cow pastures. If you travel beyond the theme parks, deep into nearby Polk or Lake Counties, you can see glimpses of this distant era. In this setting, Walt Disney assembled the real-estate deal of the century. Bankers and brokers assuredly will appreciate the drama. Once the decision was made to move forward with the project, the effort was orchestrated with utmost secrecy to avoid an upward spiral in land costs, alongside lobbying for municipal concessions from the state government. Politicians now find it easy to be critical of Disney’s de facto self-rule on its property. Yet the peculiar legal structure that offered an economic foundation for Disney World also afforded enormous growth opportunities for countless other businesses.

Use an [ affiliate link ] to purchase this book. Help keep our content free for all.

► Global Industries

amazon.com affiliate link

Ghost Road

Beyond the Driverless Car

Anthony M. Townsend

Ghost Road asks the tough questions about the driverless car that seem to be forgotten in the buzz about safer roads. Our general concern about this industry is that investors are overreaching in their expectations about the potential for the driverless car, leading to severely inflated valuation readings in public and private markets. The material here in part explains our caution, acknowledging benefits, but also putting a framework around underlying economic distortions. The book has a futurist bent to it. In the post-coronavirus era, the challenge for the autonomous-vehicle industry is that some of the assumptions about consumer behavior and urban-planning priorities become irrelevant. Stay-at-home choices imply that the development of the driverless car may be an exercise in streamlining “last mile” delivery of goods to socially-distanced consumers, rather than effortlessly transporting workers to now-irrelevant office parks.

Use an [ affiliate link ] to purchase this book. Help keep our content free for all.

► Greater Caribbean

amazon.com affiliate link

This Is Cuba

An American Journalist Under Castro’s Shadow

David Ariosto

This Is Cuba is the perfect introduction to modern-day Cuba. David Ariosto—who reported on-the-ground for CNN for a year-and a half and traveled to Cuba from the US for many more years—brings humanity to an island that is either shrouded in romance by nostalgists or cloaked in intrigue by political scientists. Readers should use the book as a launchpad to orient themselves to the rhythm of the island. Granted, local developments in Cuba (again) play second fiddle in the international headlines, given abrupt moves by the Trump administration, but percolating pressures underneath the surface suggest a mere lull to economic reform. This Is Cuba was published at the end of 2018 so the material is current on the about-face in Cuban policy under the Trump administration. In that context, Ariosto provides measured perspective on the debate between dialogueros and hardliners.

Use an [ affiliate link ] to purchase this book. Help keep our content free for all.

► Hospitality Finance

amazon.com affiliate link

I Am The Dark Tourist

Travels to the Darkest Sites on Earth

H.E. Sawyer

A first-hand account of dark tourism would seem like an odd choice to be featured here. Think again. Thanatourism is an ever-growing field of the hospitality business, albeit one that is seldom discussed in the trade. One reason is that aspects can be deeply personal. Travelers may visit dark sites—such as the September 11 Memorial and Museum in New York or the Killing Fields of Cambodia—to satiate a desire to understand death. That is hardly the sort of experience that hoteliers can scale in travel magazines. Yet it is the vein of extreme individuality that make may this industry segment so riveting and relevant. In this narrative, H.E. Sawyer offers context for dark tourism without venturing too far into the world of curiosity and macabre. Thankfully, the author approaches dark tourism as a personal journey that demands historical deference, rather than a collection of travel stories akin to curios in a gift shop. The difficult, fine-line between sociology and populism may explain why dark tourism remains a no-fly zone among hospitality-industry pundits.

Use an [ affiliate link ] to purchase this book. Help keep our content free for all.

► Investment Strategy

amazon.com affiliate link

Adaptive Markets

Financial Evolution at the Speed of Thought

Andrew W. Lo

This book fills an outsized gap in accepted financial-market theory. The MIT-based author makes the case that markets evolve, like biology, discounting the physics-envy that permeates most modern-day investment theory. His approach is particularly useful in trying to understand the strategy shifts taking place in wealth management to non-traditional assets classes. The chapter on hedge funds, “The Galapagos Islands of Finance,” should be singled out for lifting the curtain on the industry segment. “A canny observer can see financial evolution happening before his very eyes in the hedge-fund industry, in a way that is impossible to see in other, slower moving sectors of the financial markets.” Lo defends his overall approach with rigid and accessible analysis, helping to ward off naysayers. Adaptive Markets is now a prominent addition to most Wall Street bookshelves. Let’s hope that practitioners actually read it. Finding it to be such a delightful and relevant journey, they will want to read it again.

Use an [ affiliate link ] to purchase this book. Help keep our content free for all.

► Islamic Wealth

amazon.com affiliate link

The Qur’an and the Bible

Text and Commentary

Gabriel Said Reynolds

The Qur’an and the Bible is an academic work, primarily aimed at those scholars who pursue critical interpretation of religious texts. While an exegetical study may sound too severe for lay readers, the selection is highly-relevant to those looking to untangle the many strands of monotheism as part of their own journey of faith. One common problem with comparison studies is that they take a Muslim view of the Bible or a Christian view of the Qur’an. This highly-learned, highly-readable material roots its analysis in a cultural and historical perspective, avoiding an overt theological bias that might other derail analysis. Our enthusiasm for the book in part sprouts from the array of insight into these primary religious texts that is drawn from collateral documentation. At about one-thousand pages, this monumental volume is a smorgasboard of insight to be savored over time; it makes a fresh contribution to the essential underpinnings of an interfaith dialogue.

Use an [ affiliate link ] to purchase this book. Help keep our content free for all.

► Private Placement

amazon.com affiliate link

The World For Sale

Money, Power, and the Traders Who Barter the Earth’s Resources

Javier Blas and Jack Farchy

On the surface, The World For Sale is about the commodity-trading business and the billionaires that it has created. That may sound like a laborious, distant read. The authors Blas and Farchy ensure that it is not. Their pedigree at the Financial Times afforded them priority access to the inner sanctums of the commodities business, reaching well beyond perfunctory interviews with executives at Cargill or Glencore. There is plenty of entertainment value baked into the pages, including dramatic tales of dark-asset plays in Kazakhstan, Cuba, and Zimbabwe. Those stories may be de rigueur in trying to bring an opaque business to life. More constructively, The World For Sale spotlights the essential, scrappy role that commodity traders play in propelling the global economy; the book makes investment bankers look detached by comparison. A timely bonus is the insight on how Russia used oil to rebound from Western sanctions after it annexed the Crimean Peninsula in 2014.

Use an [ affiliate link ] to purchase this book. Help keep our content free for all.

► Venture Development

amazon.com affiliate link

Crack the Funding Code

How Investors Think and What They Need to Hear to Fund Your Startup

Judy Robinett

[ Full Review ] Crack the Funding Code is the perfect companion for the startup founder looking to raise angel-sourced capital, as well as the serial entrepreneur needing to brush up on knowledge of the asset-capture business. The book is organized into three primary sections: how to find the right investors, what investors are looking for, and closing the deal. In referencing investors, the author smartly uses the adjective “right” because far too many founders waste their time playing in the wrong sandbox. Chances are that you may fail with the elite venture-capital firms if you are still fine-tuning your out-of-the-gate pitch deck. But you may succeed with the local angel investor club, given the potential for discussion and dialogue with at-hand professionals. Importantly, we learn that raising capital is a process that unfolds over many, many months. Following the measured approach here may compress the effort into a shorter time frame.

Use an [ affiliate link ] to purchase this book. Help keep our content free for all.

Required Notification: The website sponsor is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com.

Book reviews are copyrighted material and may not be used or duplicated without written permission.

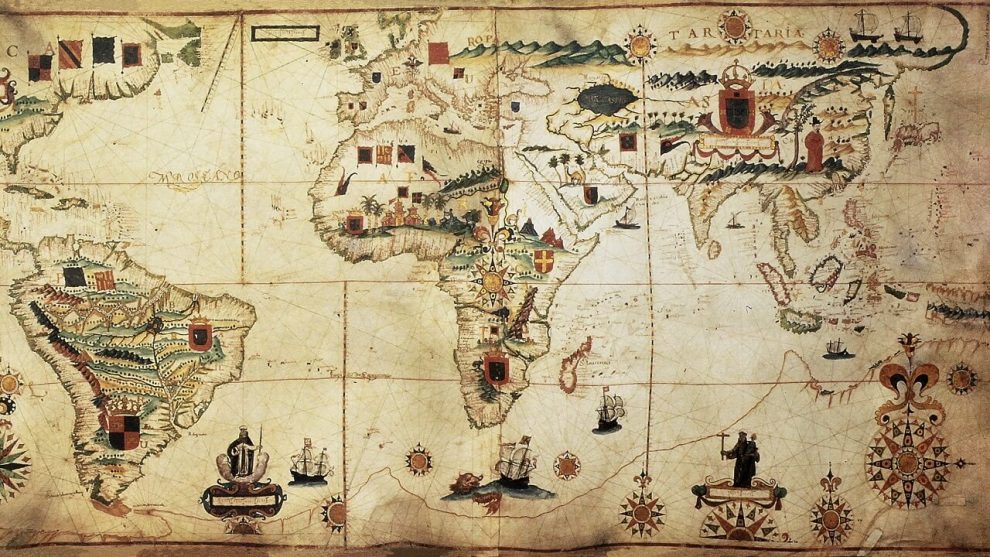

Banner: The Portuguese empire may have reached its peak economy in 1560, at the time of the Iberian Union. Credit: Marzolino at Shutterstock.